Checking Account

- Home

- Checking Account

LDTCU Checking Account

Experience unparalleled convenience and security with a Panama Credit Union Checking Account. Our checking accounts are designed to cater to your financial needs, providing a seamless banking experience with a range of benefits:

Checking account options that support your financial goals.

Compare checking accounts

-

01

High-Yield Checking

A checking account that yields 16x more than the national average2.

- $1.00

Opening Deposit - 2.47%

Interest Rate - Up To 2.50%2

APY1 - $0.00

Monthly Fee

- $1.00

-

02

Free Checking

A personal checking account that frees you of unnecessary fees4.

- $1.00

Opening Deposit - 0.02%

Interest Rate - Up To 0.02%

APY1 - $0.00

Monthly Fee

- $1.00

-

03

Restart Checking

A checking account for those who need help rebuilding financial status.

- $1.00

Opening Deposit - 0.00%

Interest Rate - Up To 0.00%

APY1 - $10.00

Monthly Fee

- $1.00

Why Choose Us?

We’re passionate about growth

LDTCU is your investment partner, committed to your financial success. Our experienced advisors provide objective advice, planning tools, and valuable resources to help you pursue your investment goals.

Get paid early

With direct deposit, your paycheck could appear in your LDTCU account up to 2 days earlier.

Keep tabs on your account activity

Sign up for Visa® Purchase Alerts to monitor your spending and detect fraudulent activity in real-time.

Protect your account when the unexpected happens

With Courtesy Pay, LDTCU will cover check, debit card or ACH transactions that won’t clear due to insufficient funds.

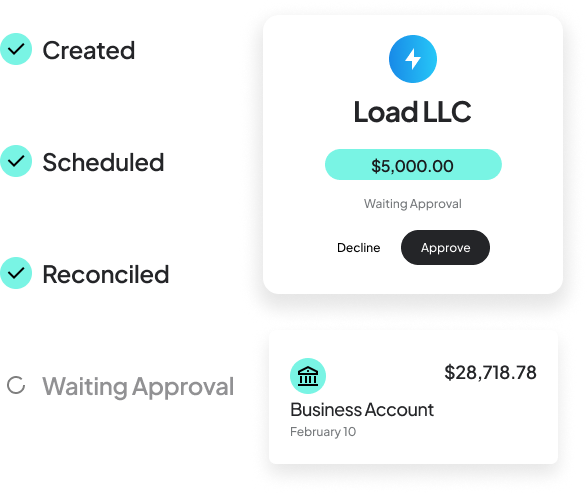

Manage your money on the go

- Transfer money between accounts

- Deposit checks directly from your mobile device

- Pay bills

- Access your account statements from anywhere, at anytime

- Track spending and create budgets

- Create custom alerts to stay on top of your finances

Wallet Integrations

Pay with your mobile device. LDTCU Mobile Pay allows you to make payments with just a wave of your phone.